tax avoidance vs tax evasion hmrc

This functionality has made Ireland one of the largest global Conduit OFCs and the third largest global Shadow Banking OFC. The changes to UC represent an effective tax cut for low income working households in receipt of UC worth 22 billion in 2022-23.

Tax fraud is different than a taxpayer being confused by the tax form or placing numbers in the wrong line.

. The last credible broad unranked list of global tax havens is the James Hines 2010 list of 52 tax havens. Actions That Can Land You in Jail. HMRC issued determinations for income tax and NICs to BBL for those tax years amounting to 1249433 and 460739 respectively.

The most common tax crimes are tax fraud and tax evasion. As a countermeasure to potential exploits. Freezing fuel duty and duty rates on alcohol will also help with.

Tax fraud involves intentionally trying to deceive the IRS. Tax evasion occurs when you willfully attempt to evade taxes. Section 110 SPVs and QIAIFs which give confidential routes out of the Irish corporate tax system to Sink OFCs in Luxembourg.

The Directive requires lawyers accountants tax advisers bankers and other intermediaries to report certain aggressive cross-border arrangements. Irelands corporation tax regime is integrated with Irelands IFSC tax schemes eg. Hypothetical contracts When the IR35 intermediaries legislation comes into play the tribunal is required to consider the hypothetical contract in this case between BBL and the BBC and ITV.

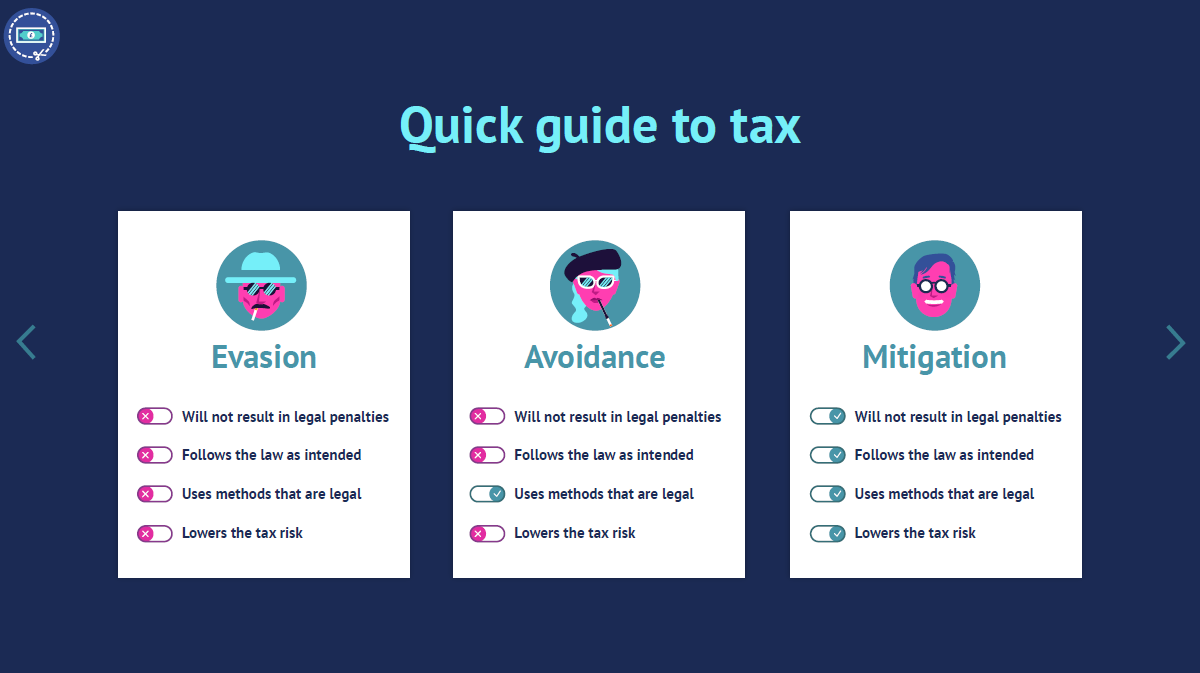

DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion strengthening tax transparency and improving information sharing between EU Member States. Post2010 research on tax havens is focused on quantitative analysis which can be ranked and tends to ignore very small tax havens where data is limited as the haven is used for individual tax avoidance rather than corporate tax avoidance.

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Differences Between Tax Evasion Tax Avoidance And Tax Planning

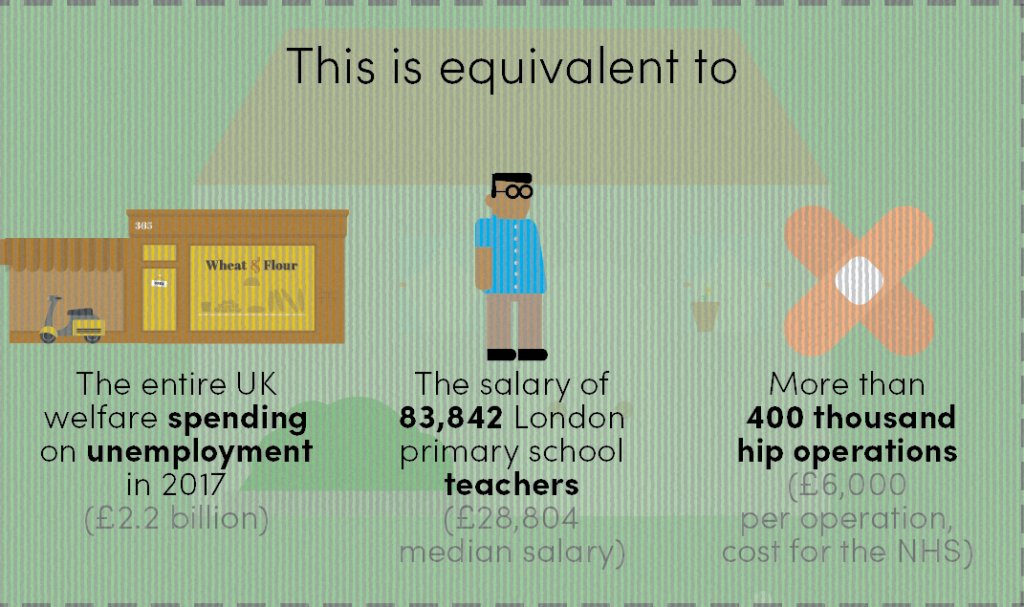

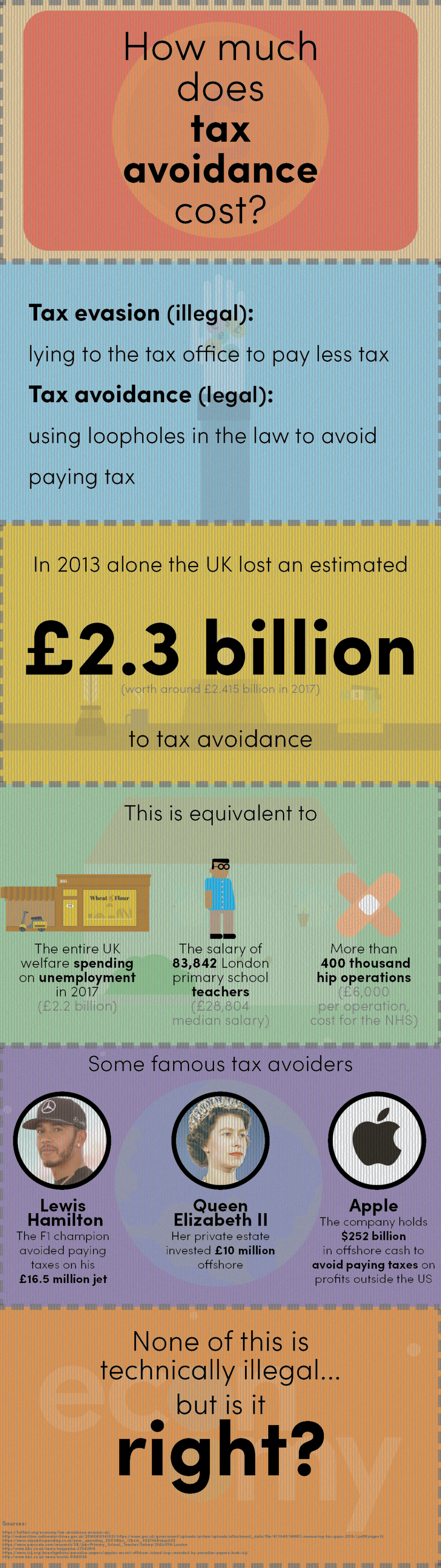

How Much Does Tax Avoidance Cost

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Follow The Money An Exercise In Tax Evasion And Avoidance

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Explainer What S The Difference Between Tax Avoidance And Evasion

Criminal Finances Act Is Your Organisation Failing To Prevent Vinciworks

Tax Avoidance What Are The Rules Bbc News

Toy Story The Difference Between Tax Avoidance And Evasion Quantitative Sneezing

What Is Tax Evasion The Motley Fool

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion What S The Difference

Differences Between Tax Evasion Tax Avoidance And Tax Planning

James Melville Pa Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus